Important Information

How Does the Process Work? And What are the Costs Involved? Here is how we can help:

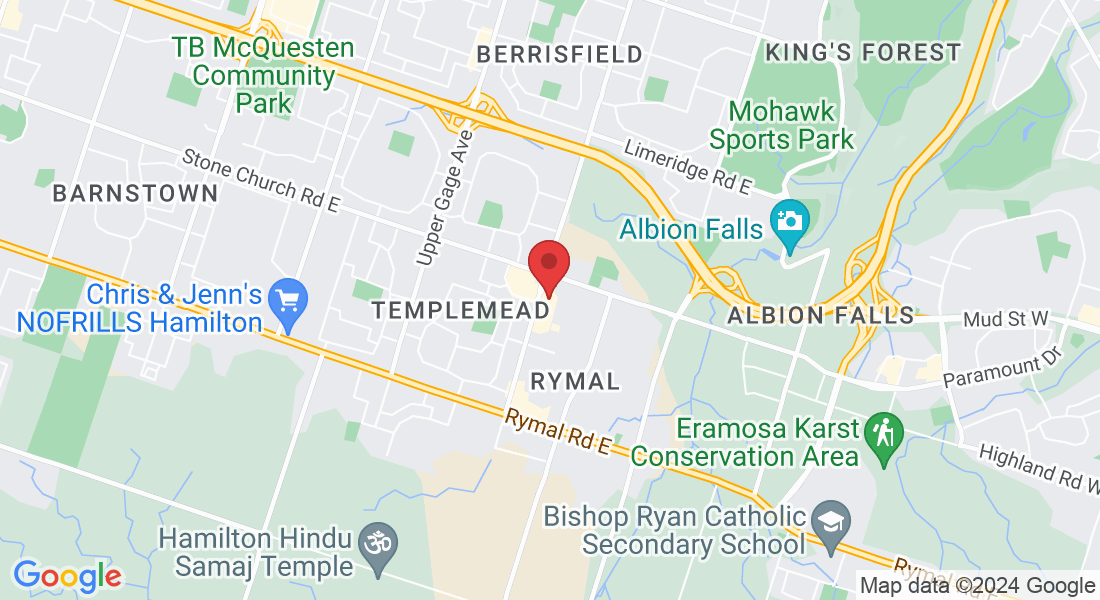

1. Complete a confidential and secure assessment at: www.philrom.com/apply-now

2. We will meet with you and discuss next steps and ensure you fully understand the process.

3. If you are interested in pursuing the Reverse Mortgage, you will be sent a summary of what you qualify for and if any documents are needed from you; as well as a financial illustration summary of your proposed Reverse Mortgage.

4. An appraisal of your home will be ordered to determine the lending value, the cost of this is typically the ONLY out-of-pocket expense

(Typically ranges from $275-$400 price range), incurred during the application process.

5. As part of the process you will be required to have independent legal advice from a lawyer

(this usually ranges from $350-$700), this ensures you have a full understanding of the nature and process.

6. The Lender’s lawyer completes the transaction

(this fee is currently $1795) and YOU RECEIVE YOUR FUNDS!

Summary:

Total fees that are deducted from the Mortgage loan amount, which includes the Independent legal advice fee from above and the Lender's lawyer fees from above which ranges from

$1795+350=$2145 to $1795+$700=$2495.

Total fees out of pocket costs are: the appraisal fee from above,ie. about $275-$400

REVERSE MORTGAGES...

This Article provided by Lawyer Pat Filice one of our Valued Partners

Top 5 Myths and Misconceptions from the Lawyer’s Perspective

Reverse mortgages are becoming more and more important for estate planning and to allow retirees to enjoy their retirement and the fruits of all of their hard work over the years. The Reverse mortgage allows qualified homeowners to borrow against the equity in their home to free up cash that they need for other important things, be that living expenses, giving a gift to children or grandchildren, paying off a debt, vacationing and seeing the world or even to invest in other businesses or real estate. Often times, a reverse mortgage is the only practical tool that some folks have to allow them to do all the things they need to do. It is a shame to see so many folks who have this tool available to them shy away from all of those wonderful life experiences because they just “can’t afford it.” Reverse mortgages can be exceptional tools to allow people to do what they would like to do and use some of the equity in their home that they have spent a lifetime building. By qualified owners, we mean individuals who are 55 years of age or older and own their own home free and clear of any mortgages or encumbrances. Despite the fact that these reverse mortgages can be so versatile and valuable to people, many folks shy away from them. They have been told all sorts of things about what they are and why they should stay clear of them. I have been helping good folks enjoy more financial freedom and benefit from the use of their hard earned equity for years with these reverse mortgages and while I agree that a reverse mortgage is not the cure for all financial ailments, I am discouraged to hear all of the misconceptions and flat out lies that people believe about how these reverse mortgages operate. So, let me set the record straight on five of the most troublesome myths and misconceptions out there that prevent people from taking a serious look at this financing tool.

MYTH #1: If I get a Reverse Mortgage, I will have to give up title to my property to the bank.

So many folks think that you have to transfer title of your property to the bank as part of the reverse mortgage transaction. Nothing can be further from the truth. You continue to own your property as before and a mortgage gets registered against the property securing the bank’s interest for the money they loaned you. In terms of the legals behind the transaction, it is registered no differently than a conventional mortgage.

MYTH #2: If I get a Reverse Mortgage, I will have to pay taxes on the proceeds. You will most certainly NOT have to pay taxes on the proceeds from the reverse mortgage. The government taxes income and capital gains, in general. When you take out equity from your home, you are not in any way receiving a capital gain nor are you receiving income. You are merely transferring the manner in which you hold an asset you already own from one form to another. For instance, if you borrow $100,000 from the bank secured by a reverse mortgage on your home, you have taken $100,000 which you had as equity in your home and converted it into cash that you can use. You have not earned any additional income nor have you received a capital gain. You get that money on a tax free basis.

MYTH #3: If I get a Reverse Mortgage, I will lose my government benefits like CPP, OAS or ODSP.

Getting money from the equity in your home with a reverse mortgage is not an income transaction. That money is not income to you. As such, it will have no effect to your Canada Pension Plan entitlement or Old Age Security. With respect to Ontario Disability Support Program entitlements, a reverse mortgage needs to be pre-cleared with the administrators and comply with certain use provisions for the funds. If you meet those requirements, it will not affect your entitlement for ODSP.

MYTH #4: If I get a Reverse Mortgage, the bank can call the loan on demand and force me to sell my home.

Your only ongoing obligations with a reverse mortgage are to pay property taxes when they become due and to make sure that the property is insured at all times. If you do that, the bank cannot demand payment nor do they have any power whatsoever to force you to sell your home.

MYTH #5: If I get a Reverse Mortgage, my children will no longer be entitled to take the family home that I own when I die.

Having a reverse mortgage does not in any way affect your ability to leave your home to your children any differently than if you had a conventional mortgage. The mortgage must still be paid off on your death or when you sell the property, regardless of whether it is a conventional mortgage or a reverse mortgage. If there is sentimental value in the family home and the children wish to keep it, they can arrange to pay out the reverse mortgage and keep the property. It’s clear that there is a bit of misinformation out there when people first learn about reverse mortgages and many of the more common beliefs are just not true. Reverse mortgages can be a powerful estate planning tool and provide security for qualified homeowners during retirement allowing them to do the things they want to do and enjoy a better quality of life.

Pat Filice is a lawyer in Ancaster, Ontario with over 20 years of experience in real estate. He has extensive experience with reverse mortgages and can provide folks with honest, fact based information on this valuable financial tool.

71 Wilson Street EastAncaster, Ontario L9B 2G3

Tel: 905-383-0828

Email: [email protected]

Website: www.filicelaw.ca

Common Uses of Reverse Mortgages

This unique financial tool offers many benefits that no other product can offer. With the CHIP Reverse Mortgage, you are able to access up to 55%* of the equity in your home, tax-free. The money you receive can be used in a variety of different ways, including:

Eliminating debt repayments

Increasing your monthly cash flow

Helping a child or grandchild

Early inheritance

Unexpected health care costs

Home repairs and improvements

A dream vacation

And more!

By accessing the equity in your home, you are able to accommodate any financial obstacles and goals you have, without having to move or sell your home.

One question I often receive is: How does a reverse mortgage work? A reverse mortgage is a loan secured against the value of your home. However, unlike a traditional Home Equity Line of Credit (HELOC) or a second mortgage, you are not required to make monthly mortgage payments for as long as you live in your home. And, you will maintain ownership and control of your home.

If you would like to learn more about the CHIP Reverse Mortgage and how it can fit within your financial plan, please feel free to email me back or give me a call. I’d be glad to answer any of your questions and we can determine if this product may be an option for you.

JAN & JACK – A CUSTOMER'S STORY

Jan & Jack live in a custom home they built many years ago. Although when they reached retirement they still had a mortgage and inadequate cash-flow to help them make ends meet.After speaking with some friends, they discovered the CHIP Reverse Mortgage. With this financial tool they were able to access $287,000 of their home’s equity, which allowed them to pay off their existing mortgage and invest in solar panels that ended up providing them an extra $500/month.Today, Jan & Jack have paid off their mortgage, have increased their monthly cash flow, and enjoy every day in their dream home. If you would like to learn more about the CHIP Reverse Mortgage, please contact me

Commonly asked Questions

A reverse mortgage from HomeEquity Bank is a smart way for Canadians 55+ to access the equity they’ve accumulated in their home as tax-free cash. Despite the fact that reverse mortgages have been in Canada since 1986, there is still a lot of misunderstanding. Some restrictions apply. For more information, please contact me.

Will the homeowner owe more than the house is worth?The homeowner keeps all the equity remaining in the home. In our many years of experience, over 99% of homeowners have money left over when their loan is repaid. The equity remaining depends on the amount borrowed, the value of the home, and the amount of time that’s passed since the reverse mortgage was taken out.

Will the bank own the home?No. The homeowner retains title and maintains ownership of the home. It’s required for the homeowner to live in the home, pay taxes on time, have home insurance, and maintain the property in good condition.

What if the homeowner has an existing mortgage?For clients that have an existing mortgage, the first step we will take is to pay off your conventional mortgage along with any other secured debt.

Should reverse mortgages only be considered as a loan of last resort?No. Many financial professionals recommend a reverse mortgage to supplement monthly income instead of selling and downsizing, or taking out a conventional mortgage or a line of credit.

What fees are associated with a reverse mortgage?There are one time fees to arrange a reverse mortgage such as an appraisal fee, fee for independent legal advice as well as our fee for administration, title insurance, and registration. With the exception of the appraisal fee, these fees are paid for with the funding dollars.

What if the homeowner can’t afford payments?There are no monthly payments required as long as the homeowner is living in the home

Our Team is made of professional Mortgage Agents that have a vast amount of mortgage and real estate experience, with the ability to communicate in Italian, German, Filipino as well as English, they are ready and eager to serve all of our clients with the highest levels of caring, respect and dedication!

Reach out to us anytime for help and advice!